Ever since I started this blog , I have recommended four pure

play seed companies here – JK Agrigenetics ,Advanta India,Kaveri Seed Company

and RJ Biotech. By the grace of god , three out of these four already turned as multi

baggers( Adjusted to stock Split and De-merger) and the recently listed RJ

Biotech returned more than 50 % in short span of time . This happened not

because of my smartness but due to sheer growth prospects of this sector in a

country like India with huge population on one side and shrinking agricultural

land on the other side. I still believe the prospects of this industry will

increase when time passes. Recently government hinted its willingness to permit field trials for more GM crops after realizing that the adoption of scientific methods are the only remedy for mounting food inflation pressure in our economy .Eventually there is every chance for such a permission to feed the increasing population in a highly populated country like India. At least five years are necessary to introduce a new variety of seed from R&D stage to commercialization after going through years long field trials and various regulatory approvals. Because of this reason, when government permits field trials, it will open up huge opportunities for existing seed companies like this company who are at various stages of R&D to develop such varieties . On this backdrop now I am recommending the newly listed Nath

Biogene India Ltd ( NBIL) as a strong buy even after considering some negative points related with

the company which will discussed later.

History

Even this company listed only recently in Indian bourses , this business

was listed since 1994 under the company named Nath Seeds. Nath Seeds came out

with an IPO at a price close to Rs.100 per share each ( If my memory is correct) even 20 years back .It was

the first pure Indian seed company made an IPO even when this business was at

very nascent stage.Later the seed business of Nath Seeds de-merged into Nath

Bio-Gene in 2004 ,but the de-merged entity took 10 years long waiting to get

listed in stock exchanges.Even the main seed production business divested to this company

earlier , the entire business (including distribution) transaction completed only in last year .Now each

of these companies consists of business as follows - Nath Seeds( real estate ,Infra development ..etc) , Agri-tech

India (corporate farming ) and Nath

Bio-Gene ( Seeds and Bio-technology).

Promoters having vast experience in this industry and company having good R&D

facilities . Company is front runner in

many varieties of seeds including BT Cotton and being present from 1979 ,Nath

is the most experienced seed company in India. Actually it was the only seed

company which did not depend only on Monsanto’s BT

technology to develop BT Cotton in India .Company developed BT cotton

using fusion genes (cry 1Ab+Cry 1 Ac) – technology available

from Biocentury Transgene ,China - in 2006 and sub-liscencd the same to many

other seed companies including the seed

division of United phosporos (now Advanta

India) .Later in 2012 ,NBIL tied up with Monsanto for their BG-2 version of BT cotton technology and thus Nath Biogene becomes the only company in India offering BT cotton based on American as well as Chinese technologies . Nath Bio-Genes

is the first seed company in Asia Pacific region to get ISO 9001 certificate.

Company producing seeds using most modern technology and having facilities to

produce seeds from 30,000 acres of land ( own and contract farming basis) span

across Andhra Pradesh, Gujarat, Karnataka, Maharashtra, Rajasthan, Orissa,

Uttar Pradesh, Madhya Pradesh and Tamil Nadu.Company’s R&D collaborators

list includes National Centre for Plant Biotechnology at IARI, New Delhi

,International Rice Research Institute at the Philippines, Biocentury

Transgenes Corporation (China) Ltd, Biotechnology Research Institute at Beijing

China, National Rice Research Institute at Sichuan Province in China, Guard

Rice in Pakistan, Cotton Development Agency (Ministry of Agriculture), Govt of

the Philippines, etc.These collaborations helping the company to access and

utilise the new Germplasm and breeding materials.Its main R&D laboratory is

located at Aurangabad and having two R&D farms one each at Isarwadi (150

Acre) and Aurangabad ( 40 Acre) .In addition to this Nath also possessing three

R&D sub stations one each at Medchal (Andhra Pradesh) , Faizabad (UP) and

Abohar (Punjab).In the last three years company introduced many new varities in

various segments which includes Jagannath-2 and Arjun-21 ( Cotton), Big-B (

Bajra) , Singhum ( Maize) and Tehelka(Rice).Many other new products like NMH

1007,NMH 1008 ..etc are under various stages of testing and evaluation. In 2011

,company got permission for conducting large Scale trial of some of the NBIL Bt. Cotton

hybrids in Pakistan.One most important positive about Nath Bio-Gene is its presence in a

wide variety of Seeds and its large marketing network.Company is present in

Cereals,Oil seeds,Vegetables,Cotton..etc and producing more than 90 variety of

seeds and present across India through 13 offices,1000 distributors and 5000 dealers.

The Negative Side

As mentioned at the beginning ,company de-merged its business into

three in 2004 .But the management kept its share holders in dark for the past

ten years by not listing its stock in any stock exchanges.I am not sure about the real reason for that whether it is only due to poor corporate governance or delay in getting listing permission after the scheme of arrangement .Another point is all

other listed companies from the same group – Nath Seeds( Teak plantation, real estate ..etc) , Agri -tech

India (corporate farming ) and Nath Pulp and Paper are trading at lower valuations. But all the

mentioned companies having either no sizable operations ,no potential or not an

attractive sector as far as investors are concerned. Even after considering all these

negative factors I strongly believe there is still huge value in this stock.

Nath Bio-Gene is currently trading at a P/E multiple of less than 7 compared

with the average P/E of 20 prevailing in this industry.

What is Ahead ?

There is lot of companies re listing after a gap of many years but

financials of such companies are nothing to comment.But here the case is

totally different .Company’s financial performance improved during this 10

years and the prospects of industry even brighter now compared with the time of

its IPO. One more point is ,at the time of de-merger of various divisions about

ten years back the reason mentioned by the management for such an action was only

for inducting a strategic partner into the company.Till now they didn’t

inducted any partner and in the recent annual report company again mentioned

the necessity to induct such a partner for further improvement in technology. I

believe this listing after a gap of 10 years is mainly for that purpose .Many

MNC players are keen to enter in Indian Seed market through associations with

Indian seed companies.In such a situation Nath Bio-Gene will be an excellent

target of such companies. If it happens there is every chance for improvement

in corporate governance issues related with the company. In recent times

company recruiting lot of professional for various posts in the company ( Check

it HERE) which also indicating company is in an expansion drive and planning to

enter into new varieties and territories.

OVERSEAS FORAY - THE UNTOLD STORY AND A HIDDEN TREASURE

Another exciting part and a possible mile stone in the history of the company may be the recent developments in its overseas operations.Since 2005 company started various options to explore the overseas opportunities.Few years back company permitted by Philippines government to conduct open field testing and multi location field trials for its fusion gene based BT cotton along with its technology partner from China . (Read related news items HERE ,HERE and HERE) These experiments conducted with the association of various govt agencies of Philippines. Completion of experiments originally scheduled in 2011-12 but delayed due to various regulatory issues .Nath is the only company got such a permission and completed all these trials now .Cotton Development Administration and Ministry of Agriculture Philippines showed complete satisfaction on NBIL's fusion Bt cotton technology and hybrids developed through this technology. Now all formalities are completed and NBIL is confident of getting the approval for commercialization of Fusion Bt cotton in Philippines in this year (2014) itself . This means company is going to reap the benefits of its past many years effort.Philippines is a country consuming 50,000 metric tons of lint cotton per year and about 97 % is coming from import.Philippines'government is planning to displacing the imports by indigenous production

mainly Bt cotton varieties.Since Nath and its technical collaborator enjoys a

near monopoly situation and it is opening a huge opportunity for the company from

next year onwards.Entry of any new company in that country should go through all tedious processes which will take many years (Nath itself took more than 5 years to reach commercialization stage). This situation offering a windfall for NBIL which is expected to commence in near future.

Listing and Price difference

As I mentioned above ,Nath Bio-Gene listed in last week in both

exchanges. According the new opening price fixation methodology implemented by

SEBI few months back , opening price of any newly listed stock will be

calculated through a call auction system with 45 minutes duration.In case of

this stock during this period somebody sold just 20 shares in NSE @ Rs.20 even though there was buyers in BSE @ Rs.50. Thus the opening price in NSE fixed

@ Rs.20 and BSE @ Rs.50 to start with .This price difference is still going on,but

I believe only blinds will sell in NSE when

there is buyers in BSE @ higher rate and the difference is

significant.So chances for order execution in NSE is very less for a buyer is concerned till there is buyers in

BSE at higher rate .Due to this reason I took BSE rate as a benchmark for valuation purpose .

Financials and Valuation

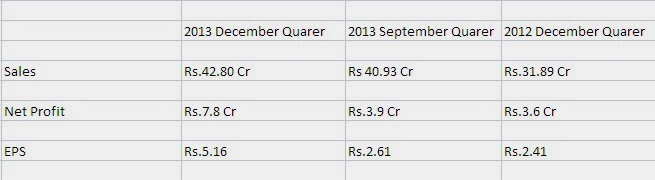

For the past many years company reporting steady growth in its key business .See table below :

On an equity base of Rs.16

Cr ,In FY 2012-13 Company reported an EPS of Rs.7.34. In the latest June quarter Company reported a top line of

Rs.110 Cr and a net profit of Rs.36 Cr

as against Rs.96 Cr and Rs.26 Cr reported in the same period of last

year. June quarter Result HERE - ( There

is a calculation error in EPS calculation in the result where 2012 June quarter

EPS indicated as Rs.38.54 instead of Rs.16.67

,but profit figure is correct .EPS calculation on old equity causes for

such an error) .EPS for this is June quarter is Rs .22.44 .One main point to

note in the result of any seed company

is ,about 90 % of sales of seed company’s are from first quarter and most probably the next three

quarters will be in loss ( You will get a clear idea about this seasonal trend

by checking the quarterly financials of JK Agrigenetics) . Here in this case

March quarter result also provided by the company which is surprisingly in profit .What I mean is , annualising the

performance only on the basis of June quarter result may give a wrong picture .Even

after considering this fact ,I expect an EPS of Rs.9 -10 in this full year.Average

P/E ratio of seed industry is 20 or above and this company’s P/E on expected FY

2014 EPS is still close to 5 which offering very huge valuation gap.

Some skeptics may argue this company deserves only low valuation on

account of delay in listing ..etc.But ,to realise how hot this sector among

investors ,we should check the valuation of some recently concluded deals in this sector.Camson Biotech is another

listed company from this space .If Nath’s corporate governance is bad ,the same

of Camson may be called as ‘worse’ .Few years back its auditors itself

questioned its accounting practices .Recently Bio Harvest ( part of CLSA

capital ) took 20 % stake in Camson Biotechnologies at a cost of Rs.65 Crore

.If CLSA paid Rs.65 Crore for a 20% stake in that company what should be the

valuation for Nath Biogene which is superior in many aspects .( Camson is

mainly a regional player with limited seed varieties in its portfolio compared

with Nath Bio-Gene) .CLSA valued Camson for Rs.325 Cr (approximately) but the

entire Nath Biogene is available for

less than 100 Cr. There is no justification for such a low valuation for

the pioneering company in seed business even after considering every negative

aspects. If we look through these angles , even @ Rs.100 we can’t say it is over

valued .

There was some

problems in this company in the past mainly connected with mounting debt issues.Asst Re-Construction company(ARCIL) extended loans by subscribing debentures during that tough times.But liability to ARCIL was still there till last year.In last year , as part of a scheme of arrangement , promoters subscribed 47 lakhs shares and infused Rs.4.7 Cr into the company .Loans from ARCIL also converted into equity by allotting 48 lakhs shares.Thus the company cleaned its balance sheet and reduced it long term debt to just Rs.1 Cr now.As I mentioned at the beginning, prospects of

sector is very bright and company’s experience and recent expansion plans giving

lot of hope. Commercialisation permission for BT cotton in Philippines is a game changer for the company which we can expect at any time, and it will place NBIL at par or above many large seed companies operating in India .

Its old share holders (IPO of Nath Seeds in 1994,de-merger to NBIL in 2004) may be not aware about the changes happened in the potential of its business during this 20 years.In addition to that they never got a chance to encash this stock during last 10 years .This may be the reason somebody sold this stock at a slump sale price on the initial days of listing .

These kind of value mismatch opportunities are rare in stock market

and if we are not ready to utilise it with some risk on account of excuses like

valuation of other companies under same management,delay in listing ..etc

,there is no meaning in remaining as a small cap investor in Indian Stock

Market.As I mentioned above ,Since seed is a seasonal business reporting loss

in all quarters except June quarter is a possibility but that is not a reason to sell this stock . Keep it for

long term .

Link to Company Website HERE

Link to the latest issue of Company's in-house publication HERE

*

As per new listing norms NBIL listed in 'T / BE ' segment with 5 % circuit limit ,but on completion of 10 trading days it will be shifted to B group with 20 % circuit limit ,which may happen by 11/02/2014

Disc: I have vested interest in NBIL

.gif)