---------------------------------------------------------------------------------------------------------------------

Dear Friends

My Sincere thanks for your overwhelming response to this learning experience.I strongly believe , those who failed to find out the answer even after spending many hours learned more lessons than those find out the answer through short cuts like social media sharing...etc.Such experience will be an added advantage in your wealth creation journey going forward.Once again urging my readers to avoid taking investment decisions based only on the name tag of companies I am posting here but only after detailed study and homework

Wishing a Happy Diwali to all my readers and your families ...........

-----------------------------------------------------------------------------------------------------------------------

If we strictly track the history of any stock which turned

as a multi-bagger, there will be at least one niche element in it. Sometimes it

may be the product/service itself, and in some other cases it may be its brand

,technology , market or something like that

.If the number of listed stocks from a particular industry is very

limited and there is a boom period for that business , normally the

listed market leader will turn as a multi-bagger, if it is

backed by a management which is able to utilise the emerging business

opportunities.One very good example for this fact is the recent appreciation in

Avanti Feeds Ltd. ,the stock I recommended

about three years back @ just Rs.68 and currently trading above Rs.1525 ( Recommendation Link HERE , Just pointed as an example and not a guarantee for similar performance in all other cases). This week let

us look into another really interesting unknown niche stock – SKM Egg Products

Exports Ltd.

SKM EGG PRODUCTS

EXPORTS - A CLOSE LOOK

This company is jointly promoted by well known SKM group and

Tamil Nadu Industrial Development Corporation Limited(TIDCO) .Out of the Rs.26

Crore equity , TIDCO holding about 7.58 % and Individuals from promoter group

holding another 46 % stake.( This data

is based on June quarter share holding and promoters made lot of market

purchases in June-September period) .Belgium based Belovo Engineering holding

another 5 % stake in SKM .Belovo

Engineering is part of BNLfood Group which supplying Egg Science & Technology ,producing and

marketing eggs, egg derived nutraceutical ingredients and food ingredients.

Plant of SKM itself established with the technical support and collaboration of

BOLOVO.Company’s manufacturing facility is located at Cholangapalayam , about 20 Km from

Erode in Tamilnadu .This is one of the largest Egg processing facility in Asia and

this state-of the art facility is located in a 35 Acre plot. Under stringent

quality conditions , company processing around 18 lakhs eggs per day and

manufacturing Whole egg powder, Albumen powder ( Powder form of Egg White),

Yolk Powder(Yellow) and recently introduced liquid Eggs.These products are

supplied mainly to Japanese and European companies for manufacturing products

like cakes, biscuits , cookies, Confectionery products, Health foods, Soup

mixes, Ice creams , dairy products ..etc. SKM established direct

Subsidiary/marketing points in its major markets viz- Netherlands,Japan and

Russia.Selling to other markets channelized through third party distributors.Since

the number of producers are less and India’s cost effective and competitive

advantages ,company is getting repeat orders from its customers. SKM’s products are ultimately used by large food

product manufacturing MNC’s like Kraft

foods .Heinz..etc. for manufacturing bakery , health care and food items.

SKM is the only

listed producer of Egg Powder and other value added products from Eggs .Even

from the unlisted space , only very few companies are manufacturing similar

products in India which includes an unlisted private company named Venkateswara

Food Products Pvt Ltd owned by the same promoters of Venky’s India and another Bangalore

based company which listed in BSE but suspended

from trading for more than 13 years.Among these few players ,SKM is the market

leader in Egg powder exports and contributing more than 50% of India’s total

egg powder export.As of now, company processing about 18 lakhs eggs per day and

utilising close to 90 % capacity to

manufacture its major products Viz- Egg Powder ,Bakery Mix and Liquid Egg.These

products are exporting to overseas markets mainly Japan and EU countries.Out of 18 lakhs eggs ,

about 5 lakhs produced from company

owned farms and the remaining is sourcing through contract farming model(

Mainly through an associate company

named SKM Universal Marketing Ltd) . In order to ensure the quality of

Eggs , company itself supplying feeds manufactured by company controlled

(leased) feed mill to the farmers and company appointed veterinary

doctors and supervisors periodically visiting farms running under contract farming agreements.Earlier,

during its tough times company's share holders approved the sale of feed mill and

farm , but only the selling of feed mill executed ( now working on lease) .This business model ensuring sourcing of

quality eggs without interruption which is otherwise a herculean task to source

close to 20 lakhs quality eggs per day.Promoter’s experience in poultry field

is one important point to note. This company was originally promoted by Mr. SKM

Maeilanandhan who is the doyen of poultry industry in India who also honoured with the Padma Shri award for his

outstanding contribution in the field of social work in 2013.

Having said , being a food product , export of these type products to developed countries is not an easy task.Stringent quality standards

and periodic quality checking are usual

in an industry like this before getting final approval for exports and usually

these formalities take many years to complete.In the beginning, company faced

many challenges in this front and it affected SKM’s past performance. From past troubled times company emerged as a winner under the able leadership of Mr.

SKM Shree Shivkumar who is the MD of the company and son of Mr.

SKM Maeilanandhan.

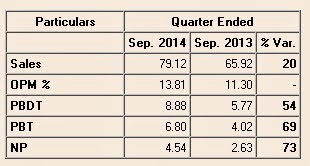

FINANCIALS

During the peak of recessionary period , it reported losses in FY 2011 and 2012 due to various reasons like lower demand, poor realization and most importantly some quality related issues due to its dependency on outside quality testing laboratories. But

with early signs of revival , company’s new products introduction and tapping

new markets ,SKM made a remarkable turnaround

in FY 2013 and further improvement in latest FY 2014.(See the below table for

details) .

To avoid any quality related issues in future , company established own quality testing lab and R&D facilities.

As per the thoughts shared during recent AGM , company is now

paying top priority to become a debt free company ( excluding working capital

debt) in near future. As part of this effort , company already reduced its debt

from Rs.51 Cr to Rs.34 Cr in last FY and

further reduced it in first six months

of ongoing FY .( Half of the loans are taken from promoters itself which they

pumped into the company to keep it afloat at the time of extremely difficult

periods few years back.) It is targeting a debt free status in next two years .

After achieving this target ,SKM is planning to hike its capacity to reach a

Rs.500 Cr company by 2017-18.

Major Negatives

Company is an export oriented unit and any recession severe than the previous one may negatively impact the demand scenario of

its products.

Company’s earnings is in Dollar and Euro and its movements

against Indian Rupee may impact its margins.

Though company sourcing part of its Egg requirements from

own farms , any adverse change in the price of feed ingredients may affect its

raw material cost.

Un-expected diseases affecting birds may create problems.

Major Positives.

As I mentioned in many of my previous postings ,while investing in small cap stocks

, promoter quality is the first point to note.The most important

positive point about this company is its promoters and management , not only

because of their experience in this field but due to their highly ethical

business practices and ‘Nothing to Hide’ mentality even towards its minority

retail share holders.I believe ,In these matters , it is difficult to find many

companies with this standard from the small caps space .

Potential of company's product is very high and, there is only very few companies in this field. SKM is the market leader handling more than 50% of India’s total egg powder

exports.

India is one of the low cost producer of Eggs and this

giving added competitive advantages to

the company . SKM captured Japanese market by competing even with American companies which indicating its high quality standards.

Entry barrier - As mentioned earlier , procuring 18 lakhs

Eggs per day is not easy to replicate by any new entrant in this field. Company

established own farms to source part of this requirement and planning to expand

the capacity of farm when it add more production capacity in its

factory.Contact farming is also designed in a systematic way where company

ensuring the quality of feed and arranging periodic visit of veterinary doctors to ensure the health of birds and

provide awareness to farmers in order to ensure the quality of Eggs to be

processed.Since the end consumers are large MNC food companies they ,always

need large quantity at stringent quality standards . To ensure this quality

standards ,it should be careful right from the beginning.Any available egg can’t be processed but it can use only the

eggs laid by birds fed with specially prepared diets , so special arrangements

should be there to ensure this quality and any available eggs in the market or

at the gate can’t be accepted.Sourcing close to 20 lakhs such eggs per day

continuously is an extremely difficult

task.Situation is more tough in the selling side . By competing with foreign

firms ,company took years to established the label of a reliable and quality

supplier in overseas markets. Being a food ingredient ,import permission to

developed countries is not easy and even in the case of Russian market ,SKM

succeeded only recently after four years continuous efforts.Because of these

reasons , still there is hardly four or five successful egg product processors

existing in India. Full traceability of end product is an important factor in

export oriented food stuff business. To ensure this ,SKM introduced a system

named “TRACKKER” which helping the company

to trace from feed ingredients level to final product level.

Scope of company’s products is very vast and so far it not

touched the biggest market –USA. Such opportunities may be tapped once the production capacity

hiked to double in next few years and company’s financial health improve

further .

Using its own R&D , company introducing new products and

its recently introduced liquid Eggs receiving

overwhelming response from customers. Considering the increasing

cholesterol related health issues , liquid white egg may turned as a money spinner

for SKM in the years to come. Company also succeeded in increasing the shelf

life of products and this will help to penetrate more overseas markets.

During the time of

last recession its business badly affected mainly because of its higher

concentration in few markets .To avoid such a situation in future SKM is now

expanding its geographical presence .Company’s years long efforts to get an

entry in Russian market succeeded recently and they got approval from Russia

now. Company started trial shipment and

it is expected to become a priority market for SKM in future. Company also entered in Nigeria and South African Markets

recently.

Promoters efforts to become a debt free company is not a

gimmick and they are working sincerely for that ,which is evident from the

reduction in debt levels in recent times. Targeted debt free status by next

few years will give direct positive impact in its bottom line and make this

already attractive company as a compelling buy.

Once, majority of the shares of promoters were pledged with banks to avail loan facility ,but now only 24 % is pledged and balance released on repayment of loan.Remaining is expected to become pledge free in next 2-3 years.

Another most important factor is the multi angle benefit to

the company due to global recovery. From

last few year’s financial performance , it is evident that even a

small positive change in global economy

augers well for SKM .It is helping the company in three different ways

·

* Increased Demand from foreign markets

·

* Being an Export Oriented Unit , appreciation of

Dollar and Euro against Indian Rupee is positive for the company

·

* Strengthening

of Dollar will reduce the competitiveness of US manufactures in foreign

markets especially in Japan where SKM’s

major competitors are US manufactures.

There is no big local market for processed egg as of now. But

history says , In case of India ,

imitating the trends of food habits from developed markets is an eventuality

. This will happen in future for sure. In such a situation , the peer company

with years experience will benefit a lot and it will help the company to de-risk its business model by reducing

over dependence on export – if necessary – in future.

Cost control efforts taken by management and their attention

even in minute factors is another important point if we look through the eyes

of a minority share holder. Usage of

recycled waste water to irrigate the garden and lawn in front of the factory is

an example for this zero wastage strategy. They are even selling egg shells and

earning few thousands in each year.

Conclusion

I believe SKM Egg Products Export is a company operating in

an Industry with huge potential in future and at the same time with high entry

barrier.Most important point is the management’s high ethical standards they exhibited even

during their tough times. I strongly believe , god will always with such people

and lead them into more success . This is one rare company

from the micro cap space I can assure one thing – if there is any failure for this

company in future ,it will be only because of a reason beyond the control of

promoters and its management.That much is the efforts they are taking to bring back the company into the right direction and further growth.For FY 2013-14 , on a consolidated basis company

reported a Sales of Rs.264 Cr , a net profit of 7.20 Cr and an EPS of Rs.2.76. Stock

of SKM appreciated post declaration of full year result and currently trading

around Rs.60 .Prima-facie on a P/E based valuation method , this is neither cheap nor

expensive.But to get a fair picture about last year profit ,we should dig deep.

This 7 .20 Crore profit arrived after providing an Exchange fluctuation loss of Rs.7.36 Crore and another one time expense

of Rs.4.15 Cr. Considering the chance for stability in Rupee value ( compared with

last year) less forex loss

is a possibility in current year .In the case of the mentioned one time expense

incurred in last year , there is no chance to repeat it again. If we consider

these two important hidden factors,valuation picture will change positively. In addition to this , company’s debt

reduction will directly impact its bottom line and EPS figures going forward.Along with

this quantitative figures, SKM’s market leading position, robust business plans

with introduction of new products and penetrating new markets supported by a

highly ethical management which is taking every effort to reach a debt free Rs.500 Cr company in next few years makes its an attractive pick for long term investors

even at current level.

Listing

During its worse time in 2011-12 ,company sought share

holders approval to de-list its stock from BSE and remain listed only in one

exchange. In the 17th AGM of the company, share holders approved a

special resolution for this purpose and hence at present SKM Egg Product

Exports is trading only in NSE( De-listing procedures from BSE yet to completed and theoretically still it is listed in BSE but suspended from trading ) and currently trading around Rs.60

Link to Company Website HERE

Disc: It is safe to assume that, I have vested interest in it as a share holder.